Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global — 14 Apr, 2020

By S&P Global

Describing the current moment as “The Great Lockdown,” the International Monetary Fund projected that the global economy will contract 3% this year—reversing its forecast from earlier this year that it would grow 3.3% and projecting the worst downturn since the 1930s. In its outlook, the IMF warned that “it is very likely that this year the global economy will experience its worst recession since the Great Depression, surpassing that seen during the global financial crisis a decade ago.”

The IMF projected oil prices to average $35 a barrel this year, down from its January predictions of $58.03/b in 2020 and $55.31/b in 2021.

IMF Chief Economist Gita Gopinath said 100 of the global lender’s 189 members have reached out to get emergency funding. Yesterday, the IMF approved approximately $214 million in immediate debt relief for 25 of the world’s poorest countries, mainly in Africa and the Caribbean, by canceling their debts to the fund for the next six months. The grant will help the countries “channel more of their scarce financial resources towards vital emergency medical and other relief efforts”, according to a statement by IMF Managing Director Kristalina Georgieva.

U.S. President Donald Trump announced that he plans to halt funding to the World Health Organization, blaming the health organization for what he described as “severely mismanaging and covering up the spread of coronavirus.” President Trump has taken issue with the WHO’s February advisement against imposing travel restrictions to places with outbreaks, which it said was not an effective means of stopping the virus’ spread. The Trump administration has faced criticism for downplaying the seriousness of the crisis and for its slow response to the outbreak.

Unprecedented in their speed, depth, and universality, government measures to try to control the spread of COVID-19 appear to have helped protect populations and healthcare systems from overwhelming infections and fatalities. Public health and economic experts insist that this doesn’t mean economies can reopen as normal any time soon. Large-scale changes may need to be in effect for many months to combat waves of new cases. As government officials in the U.S., Europe, and Asia consider plans to at least partially reopen economies, the pandemic continues to devastate countries in all regions of the world.

As of today, 1.97 million people are confirmed to have coronavirus and 125,900 people have died, according to the latest Johns Hopkins University data. Deaths in Italy have surpassed 21,000. France’s death toll topped 15,000. Fatalities related to COVID-19 in the U.K. may be 10% higher than the official toll of more than 12,000, according to data released by the Britain’s Office of National Statistics.

“The single most important thing we can do for the health of our economy is to protect the health of our people,” U.K. Chancellor of the Exchequer Rishi Sunak said, insisting the response is “not a case of choosing between the economy and public health.”

Sweden, which hasn’t implemented strict lockdown orders, now has had more than 1,000 deaths due to the virus, prompting denouncement of the national response from the country’s top health experts. In a revised tally to include those who didn’t test positive but were believed to have died from coronavirus, New York City’s death toll skyrocketed to more than 10,000, bringing total U.S. deaths to around 26,000. In Iran, 98 people have died in the past 24 hours, marking the first daily reporting in around a month where fewer than 100 people died. Kenya’s outbreak is moving from city centers into rural areas, threatening populations who lack the ability to social distance.

If market volatility is any indication, investors are acting on a belief that economies will reopen sooner rather than later. The S&P 500 Index shot up 3.1% today, closing at its highest level since March 10. The price of gold, which has acted as a safe haven throughout this pandemic, hit fresh highs with bids around $1,740/oz—an eight-year high and up $80 from a week earlier. Crude-oil futures were marginally higher in midmorning trading in Asia Tuesday as prices steadied after the OPEC+ deal, but downside risk remains amid coronavirus-related developments that could weaken demand further.

In an interview with S&P Global Platts, Oman's Minister of Oil and Gas Mohammed al-Ruhmy said the historic OPEC+ oil production cut of 9.7 million b/d won’t have a major effect on the balancing of the market “but 19 million b/d, I think will.” Saudi Energy Minister Prince Abdulaziz bin Salman, one of the deal’s main negotiators, said in a briefing with reporters that the collective actions will put a floor under prices and get all producing countries on the same page.

The coronavirus crisis has dampened global demand not only for oil but also dairy. According to S&P Global Market Intelligence, the closure of thousands of restaurants, offices, hotels, schools, and coffee shops has dramatically reduced demand for milk, butter, cheese, and ice cream in the U.S., Europe, and parts of Asia. Nationwide shutdowns have led to large-scale absences of workers in dairy factories and milk processing plants.

Today is Tuesday, April 14, 2020, and here is essential insight on COVID-19 and the markets.

IMF slashes 2020 oil price forecast to $35/b as global economy set to contract 3%

Oil prices will average $35/b in 2020 as the global economy contracts 3% in the worst deterioration in economic conditions since the Great Depression in a best-case scenario and stay around that level for 2021, the International Monetary Fund said Tuesday in its World Economic Outlook. In its January report, the fund assumed an oil price of $58.03/b in 2020, and $55.31/b in 2021. Oil prices are currently trading below the fund's forecast despite the OPEC+ group agreement on Sunday to cut a record 9.7 million b/d in May and June this year and gradually decrease cuts through April 2022.

The fund, which had projected a 3.3% growth in 2020 only in January, said the 3% contraction scenario was based on the pandemic subsiding in the second half of 2020. "Much worse growth outcomes are possible and maybe even likely," the IMF's Economic Counsellor, Gita Gopinath said in a foreword for the report. "This would follow if the pandemic and containment measures last longer, emerging and developing economies are even more severely hit, tight financial conditions persist, or if widespread scarring effects emerge due to firm closures and extended unemployment."

—Read the full article from S&P Global Platts

Pragmatic actions by producing countries will stabilize oil market: Saudi energy minister

Despite a sweeping agreement that calls for record production cuts and massive purchases of crude to fill strategic reserves, OPEC and its allies face a flood of skepticism that they can mop up the oil market's glut in the face of the coronavirus pandemic. But Saudi energy minister Prince Abdulaziz bin Salman, a central negotiator of the deal, said the collective actions will put a floor under prices and, more importantly, put all producing countries on the same page.

"Whatever will bring stability to the market, in an even-handed approach where everybody is contributing, I think the bigger picture now is this pragmatic approach that has enabled us to see to it where other countries outside of OPEC+ — Supreme OPEC+ — are engaged," the minister said in a briefing with reporters Tuesday. "It's something I never thought I would see in my life."

—Read the full article from S&P Global Platts

Stress Testing Energy Companies in the Current Environment

This paper highlights several ways to stress testing companies within the energy industry, particularly with regards to impact of COVID-19 and the current oil price shock. S&P Global Market Intelligence conducted a statistical analysis in order to assess the impact of persistent low oil price on Q2 2020 Probability of Default in the energy industry. In addition to this paper, S&P Global Market Intelligence is also working on the creation of an oil price scenario tool factoring in various aspects from a supply and demand perspective.

—Read the full report from S&P Global Market Intelligence

Law firms brace for coronavirus-driven wave of energy, mining restructurings

The energy sector is just one of many likely to be scrambling for financial and legal aid in the wake of severe disruption from the COVID-19 pandemic, and law firms across the U.S. are bracing for a flurry of new demand for restructuring and bankruptcy expertise.

Most large U.S. coal mining companies already filed for bankruptcy in the last five years, but companies in the space are facing increased pressure and are drawing down revolvers to brace for potential liquidity needs in the face of dire predictions about demand. Oil and gas producers, many of which already carried speculative-grade, distressed debt before the pandemic, started to file for bankruptcy while making significant cuts to capital spending plans. The renewable energy sector and utilities are also likely to be hit by lower demand and liquidity issues. Law firm Jackson Kelly PLLC expects a peak in corporate restructuring and bankruptcy activities in July or August, managing member Ellen Cappellanti said in an April 9 email. However, the situation with the new virus is changing, and the firm is assessing that prediction daily.

—Read the full article from S&P Global Market Intelligence

Bunker fuel inspections expected to drop as coronavirus measures take center stage in shipping

The transition to the International Maritime Organization's global low sulfur mandate and the high sulfur fuel oil carriage ban has been relatively smooth so far but inspections are set to drop as the focus has shifted to containing the coronavirus' spread, with safe bunkering practices, crew changes and continuity of the global supply chain in shipping receiving more attention, sources say. Some port states will suspend enforcement measures, a shipping industry source said.

"There is also a reluctance to board vessels unless absolutely necessary because of COVID-19. So there has probably been considerable fewer inspections than if there was not a global pandemic," he added. Another shipping source added that restrictions on ship personnel at some ports is also making testing bunker samples difficult. "Our correspondence with port authorities these days are centered around COVID-19 preventive measures, the focus is definitely not on IMO 2020 measures," a Taiwan-based bunker supplier said. This comes after the IMO last week said it had held an online meeting with representatives of the 10 port state control regimes which cover the world's oceans. The regimes reported that the number of physical on-board ship inspections has fallen considerably to protect both port state control officers and seafarers, it said in a statement. However, the IMO said that the regimes continue to work to target high-risk ships which may be substandard.

—Read the full article from S&P Global Platts

Q1 2020 Performance Review for the S&P Risk Parity Indices

It comes as no surprise that the COVID-19 pandemic had a profound effect on global markets in the first quarter of 2020. The S&P 500® suffered steep declines, and U.S. Treasury yields fell (prices rose) as investors favored a flight to quality. In commodities, the S&P GSCI ended March down an extraordinary 29.4%, the largest monthly drop in performance in its almost 29-year history. Similarly, the first quarter proved a challenging one for the S&P Risk Parity Indices, with all of the volatility targets posting double-digit losses. This was to be expected given the sudden and dramatic decline in the aforementioned asset classes. Since their launch in 2018, the S&P Risk Parity Indices have been adopted by several asset owners and asset managers as a benchmark for active risk parity funds. The performance of the S&P Risk Parity Index – 10% Volatility Target was very much in line with the manager composite for the first quarter.

—Read the full article from S&P Dow Jones Indices

Passive Investing: An Evergreen Option

The current COVID-19 situation has created an unprecedented outlook that calls for reinvention and new solutions. Markets across asset classes are witnessing substantial volatility, which is making investment decisions more challenging. Each asset class with its own characteristics is highlighting trends, which is keeping investors perplexed.

Comparing some global trends with those from India for the one-year period ending March 31, 2020, the S&P BSE SENSEX touched historical lows, just as other global indices such as the S&P 500® have. On the fixed income side, the S&P BSE India 10 Year Sovereign Bond Index has held its ground and been range-bound, though it has also seen some minimal declines. The S&P GSCI All Crude, a subindex of the S&P GSCI that is designed to measure the performance of the crude oil commodity market, recorded its 10-year low on April 1, 2020. The S&P GSCI Gold, a subindex of the S&P GSCI that is designed to measure the performance of COMEX gold futures, rose in March 2020 but with some volatility.

—Read the full article from S&P Dow Jones Indices

Gold price hits highest since 2012, eyes $1,800/oz

The gold price tested fresh highs Tuesday after the Easter break as the wider market continued to seek safe havens from the economic fallout from the continued coronavirus pandemic with some now expecting it to hit $1,800/oz. Gold was spot bid around $1,740/oz as of 1500 GMT, an eight-year high, up around $80 from a week earlier. As the world teeters on recession caused by the coronavirus pandemic investors are seeking ways of hedging losses, one of them being buying gold futures.

—Read the full article from S&P Global Platts

As markets roil, analysts, investors keeping close eye on insurers' hybrid bonds

Recent falls in European insurers' solvency ratios are a long way from triggering default clauses in certain hybrid bonds they have issued, analysts say, but the uncertainty around the coronavirus pandemic means they are monitoring the situation closely. The coronavirus outbreak has caused equity markets and interest rates to fall and credit spreads to widen, hitting insurers' solvency ratios. Moody's said in a March 31 report that the regulatory solvency ratios of the European insurers it rates had fallen by 20 percentage points since the beginning of 2020. Lloyd's of London announced March 26 that its central solvency ratio had fallen to 205% as of March 19 from 238% at the end of 2019.

—Read the full article from S&P Global Market Intelligence

Dissecting APAC Markets during Volatile Times with Portfolio Analytics

In the first article of S&P Global Market Intelligence's application series, ‘AFL Style Analysis during Periods of Duress’, S&P Global Market Intelligence utilized the Alpha Factor Library (AFL) tool to understand the style performance and regime analysis of the APAC equity markets under stress conditions such as financial and health crises. To help gain further insight into market impacts across Asia-Pacific, S&P Global Market Intelligence will now use the Portfolio Analytics (PA) tool on the S&P Capital IQ platform to conduct analysis on country and sector performance, as well as valuation analysis and analyst revisions.

—Read the full report from S&P Global Market Intelligence

COVID-19: Coronavirus- And Oil Price-Related Public Rating Actions On Corporations, Sovereigns, And Project Finance To Date

In response to investors' growing interest in the COVID-19 coronavirus and its credit effects on companies, S&P Global Ratings is publishing a regularly updated list of rating actions taken globally on corporations and sovereigns as well as summary table and supporting charts. Also included is a summary of project finance rating actions. These are public ratings where S&P Global Ratings cites the COVID-19 coronavirus, oil prices, or both as a factor. This information is as of April 10, 2020.

—Read the full report from S&P Global Ratings

Global dairy industry reels from lower demand, falling prices in virus fallout

The global dairy industry is struggling with lower demand and a steep decline in prices as the spreading COVID-19 outbreak wreaks havoc on its supply chains. The closure of thousands of restaurants, offices, hotels, schools and coffee shops has dramatically reduced demand for milk, butter, cheese and ice cream in the U.S., Europe and parts of Asia. Countrywide shutdowns have led to the large scale absence of workers in dairy factories and milk processing plants. Meanwhile, a large quantity of domestic orders have been canceled, exports have been hit and milk prices have slumped.

The impact is vast: The global milk products industry generates $716 billion of revenue each year, of which $85 billion is in the U.S., according to Statista. India is the world's largest milk producer, with 22% of global production, followed by the U.S., China, Pakistan and Brazil, according to the Food and Agriculture Organization.

—Read the full article from S&P Global Market Intelligence

CHART OF THE DAY

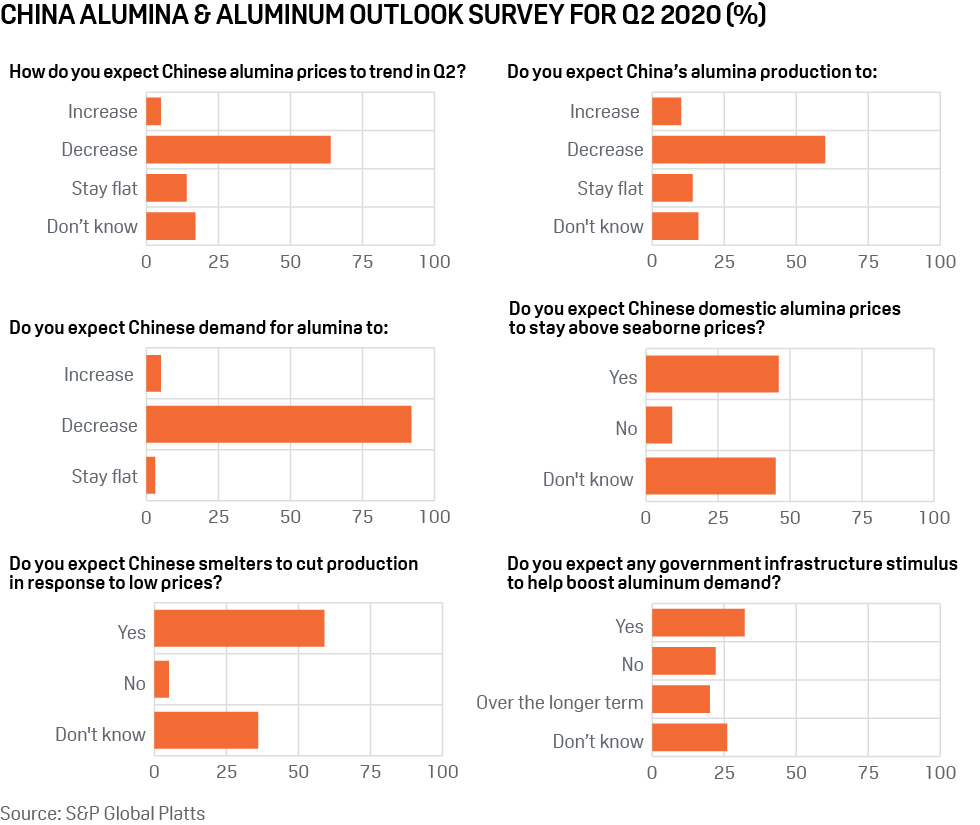

China alumina faces bearish Q2 outlook as COVID-19 hits demand: Platts survey

China's alumina prices in the second quarter are expected to suffer from a sharp contraction in domestic and global demand as a result of the coronavirus pandemic, a survey by S&P Global Platts showed. As a result, primary aluminum prices are expected to be in a range of around Yuan 11,500-13,000/mt ($1,630-1,842/mt) in the April-June quarter, with some survey participants seeing it as low as Yuan 10,000/mt, Platts data showed.

The survey saw 64% of respondents expecting a drop in Chinese domestic alumina prices in Q2, while 92% saw demand for alumina deteriorating in the quarter. Given the weak pricing outlook, 60% of respondents believed China would cut alumina production in the current quarter.

—Read the full article from S&P Global Platts

China's March steel exports rebound 2% on year, but likely to plunge in May-June

China's finished steel exports are expected to drop sharply over May-June despite a rebound in March due to a recovery in domestic demand but weak export demand because of the coronavirus pandemic, traders said. Steel imports are likely to continue rising through the second quarter for the same reason.

China's finished steel exports increased by 2.35% year on year to 6.476 million mt in March, the highest since July 2018, customs data released Tuesday showed. Exports rebounded in March after falling 27% year on year over January-February. Exports in Q1 were still 16% lower year on year at 14.286 million mt. Steel imports into China rose 26.5% on the year to 1.137 million mt in March. In Q1, imports grew 9.7% to 3.178 million mt. As a result, China's net steel exports were down 1.64% on the year at 5.339 million mt in March, and down 21.33% on year at 11.108 million mt in Q1.

—Read the full article from S&P Global Platts

COVID-19: Coronavirus-Related Public Rating Actions On Nonfinancial Corporations And Affected European CLOs

In response to investors' growing interest in the COVID-19 coronavirus and its credit effects on companies and European collateralized loan obligations (CLOs), S&P Global Ratings is publishing a regularly updated list of rating actions taken globally on nonfinancial corporations, which have had an effect on European CLOs, and a summary table. These are public ratings where S&P Global Ratings mentions the COVID-19 coronavirus as one factor or in combination with others.

—Read the full report from S&P Global Ratings

Interview: Omani oil minister says OPEC+ production cut deal will not balance market

The OPEC+ production cut agreement, which will see 9.7 million b/d taken out of the market starting in May, will not sufficiently balance the coronavirus-hit market, Mohammed al-Ruhmy, Oman's minister of oil and gas, said Tuesday. After several days of talks, members of the OPEC+ alliance agreed to collectively cut production by 9.7 million b/d in May and June, followed by a 7.7 million b/d reduction in H2 2020 and 5.8 million b/d from January 2021 through April 2022. The agreement is aimed at counteracting the plummet in global demand caused by the coronavirus pandemic.

In an interview with S&P Global Platts, Rumhy said 9.7 million b/d will not have a major impact on the balancing of the market. "But 19 million b/d, I think will," he said. "Less oil is going to be produced from shale formations in the United States," Rumhy said. "And many countries are reporting reduced production because of economic reasons, it's not economic for them to produce at current prices. If you don't work on any oil field, it doesn't matter where, they will decline. These reservoirs need a lot of attention."

—Read the full article from S&P Global Platts

How The U.S. Municipal Housing Sector Is Bracing For COVID-19 Related Impact

The seismic shift in the U.S. economy, along with provisions in the Coronavirus Aid, Relief, and Economic Security (CARES) Act to keep renters and homeowners in their residences through eviction and foreclosure moratoriums, will add significant stress to the U.S. municipal housing sector over the next several quarters. This was a central reason for S&P Global Ratings revising their outlook on the sector to negative. As the situation plays out, S&P Global Ratings expects that any rating actions in the housing sector will generally lag this downturn, in contrast to other sectors where the financial effects have been immediate.

The sudden economic stop has created a backdrop of uncertainty and volatility. Unemployment, coupled with eviction and mortgage foreclosure moratoriums, will stress the housing sector, particularly housing finance agencies (HFAs) and stand-alone multifamily properties. Age restricted properties in particular could face pressure on net operating income due to extended vacancies and higher expenses from the pandemic. Liquidity will be key to navigating through any interruption or decrease in revenues for HFAs, community development financial institutions (CDFIs), and multifamily property owners.

—Read the full report from S&P Global Ratings

What To Expect When U.S. Insurers Report First-Quarter Results Amid COVID-19

S&P Global Ratings expects COVID-19's shadow over capital markets will influence U.S. insurers' earnings in the first quarter. However, its effect on morbidity and mortality likely won't have as much of an impact on underwriting performance for the quarter.

The much needed shelter-in-place guidelines used to slow the spread of the pandemic have unfortunately significantly affected capital markets and economic conditions in the first quarter. While conditions in the financial markets have improved in recent weeks, investment portfolios across the three insurance sectors—life, health, and property/casualty (P/C)—have likely felt the impact of equity volatility and weakening credit and debt markets. But outside of investment portfolios, fundamental differences in the liabilities of these three insurance sectors will mean COVID-19 will affect their underwriting results differently. S&P Global Ratings expects U.S. health insurers to likely report better-than-expected underwriting results, life insurers to face a serious test to their hedging strategy, and P/C insurers' underwriting performance to be the least affected of the three in the first quarter. S&P Global Ratings' outlook on ratings in the sectors remains stable for now.

Capital market volatility will weigh on U.S. life, health, and P/C insurers' investment portfolios, while first-quarter underwriting performance will differ across the three sectors. S&P Global Ratings' outlooks on the life, health, and P/C insurance sectors remain stable. U.S. health insurers will likely see better-than-expected underwriting performance in the first quarter due to meaningful deferral of nonemergency medical services. U.S. life insurers will see a true test to their hedging strategy, especially as it applies to market-sensitive liabilities. U.S. P/C insurers are likely the least affected of the three in the first quarter, with underwriting profitability remaining safe for now.

—Read the full report from S&P Global Ratings

Coronavirus-related revolving credit drawdowns grow to $222B via 414 issuers

The tally of U.S. corporate entities drawing upon existing revolving credit lines since March 5 grew by $2.1 billion yesterday as companies continue efforts to shore up liquidity amid the coronavirus crisis. The revolving credit drawdown total since March 5 — when LCD began tracking this info — is now $222 billion, via 414 credit facilities. Historically, these revolving credit lines could go largely undrawn and might be used for working capital, as a backup line of credit or for corporate cash emergencies. Many of these debt issuers have cited in SEC filings the coronavirus as the reason for tapping these lines, along with an "abundance of caution."

—Read the full article from S&P Global Market Intelligence

JPMorgan says biggest unknown for credit is effectiveness of coronavirus relief

Management at the largest bank in the U.S. said future credit costs will be highly dependent on how effective federal relief is at bridging customers back to employment, and that reserve additions in the coming periods could exceed the massive, $6.8 billion build the bank recorded in the first quarter. JPMorgan Chase & Co. CFO Jennifer Piepszak said that the bank's provision expense for the first quarter took into account aid the federal government is providing, including direct checks to households and expanded unemployment benefits, in addition to JPMorgan Chase's own offer of payment deferrals to customers. "How they ultimately play out is of course probably the biggest unknown right now," she said in a conference call with reporters April 14.

So far, Piepszak said that about 4% of the bank's consumer "service book" has asked for forbearance. Outside of those customers, payment rates have been ordinary, she added. "We did see a slight uptick in late payments in auto," she said. "But I would say we haven't seen anything meaningful as yet."

—Read the full article from S&P Global Market Intelligence

Alleged COVID-19 misinformation raises regulatory questions for broadcasters

With broadcasters helping to keep Americans informed and connected during the coronavirus pandemic, various interest groups are raising questions about whether station owners, or the agencies that regulate them, need to do more to verify broadcast news or advertising.

The broadcast industry recently found itself at the center of two controversies focused on the airing of alleged misinformation about the coronavirus. While some groups believe broadcasters such as Sinclair Broadcast Group Inc., Nexstar Media Group Inc., iHeartMedia Inc. and Cumulus Media Inc. have as much duty as social media companies, if not more, to protect consumers from fraudulent or inaccurate information, industry observers say the law has long protected broadcast editorial decisions from government influence. Thus, they say it is unlikely the U.S. Federal Communications Commission will take a more active role in policing news or advertising content during the pandemic.

—Read the full article from S&P Global Market Intelligence

Indian drugmakers see gains as Trump promotes potential coronavirus treatment

Stocks of three Indian drugmakers surged and outperformed the sector amid speculation that an autoimmune and malaria therapy they produce could be effective to treat coronavirus. U.S. President Donald Trump has been promoting the drug — hydroxychloroquine — since mid-March, stirring interest as healthcare professionals and governments around the world search for effective treatments for COVID-19, the disease caused by the novel coronavirus. Though the drug has not yet been approved to treat coronavirus, and experts have warned that side effects can include heart arrhythmias, investors have nonetheless bet on Indian manufacturers of the treatment.

Because the drug is approved in the U.S. to treat malaria, lupus and rheumatoid arthritis, U.S. doctors can prescribe it off-label for other uses. On March 28, the U.S. Food and Drug Administration issued an emergency use authorization for doses of hydroxychloroquine in the federal stockpile to be used to treat hospitalized patients with coronavirus. Meanwhile, the drug is undergoing clinical studies to test its safety and effectiveness in treating COVID-19.

—Read the full article from S&P Global Market Intelligence

PODCAST OF THE DAY

Listen: Coronavirus impacts power fundamentals across the world, with implications for North America

US power markets are following similar trends from Asia and Europe following the coronavirus track, which is creating supply and demand challenges. Peakload averages were down more than 10% in March compared with a year earlier, power dailies have yet to see a dramatic impact, and pricing forwards experienced movement that was more drastic in March for April and May packages.

—Subscribe to the Commodities Focus podcast from S&P Global Platts

Texas oil regulator weighs 20% production cuts against 'free market' opposition

Sign Up Texas energy regulators began debating Tuesday whether the state should impose 20% crude oil output cuts on producers to help stabilize prices amid the global coronavirus pandemic. The issue is under consideration after OPEC+ agreed to cut production by nearly 10 million b/d, although that's still far short of at least 20 million b/d of expected global demand destruction. With Texas producing close to 5 million b/d of crude, a 20% reduction would remove roughly 1 million b/d, but opponents said the state should let the free markets work to trigger organic reductions.

—Subscribe to the Commodities Focus podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language